Gross Annual Income Me Meaning

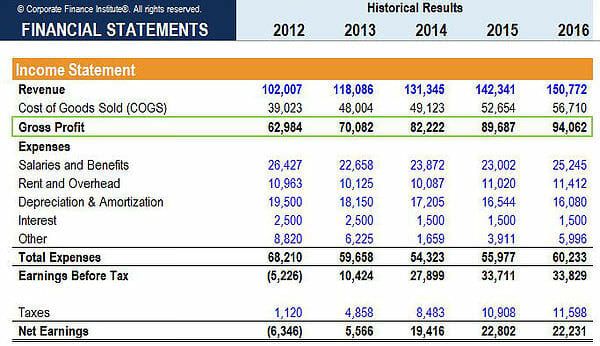

As for companies we use the concept of Gross Profit or Gross margin. 35 x 16 x 52 29120.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

For example if you work roughly 35 hours per week every week and you earn 16 per hour your gross annual income would be.

Gross annual income me meaning. The concept applies to both individuals and businesses in preparing annual tax returns. You can usually find gross income as a line on a paycheck or W-2. The 52 represents the number of weeks you work throughout the year.

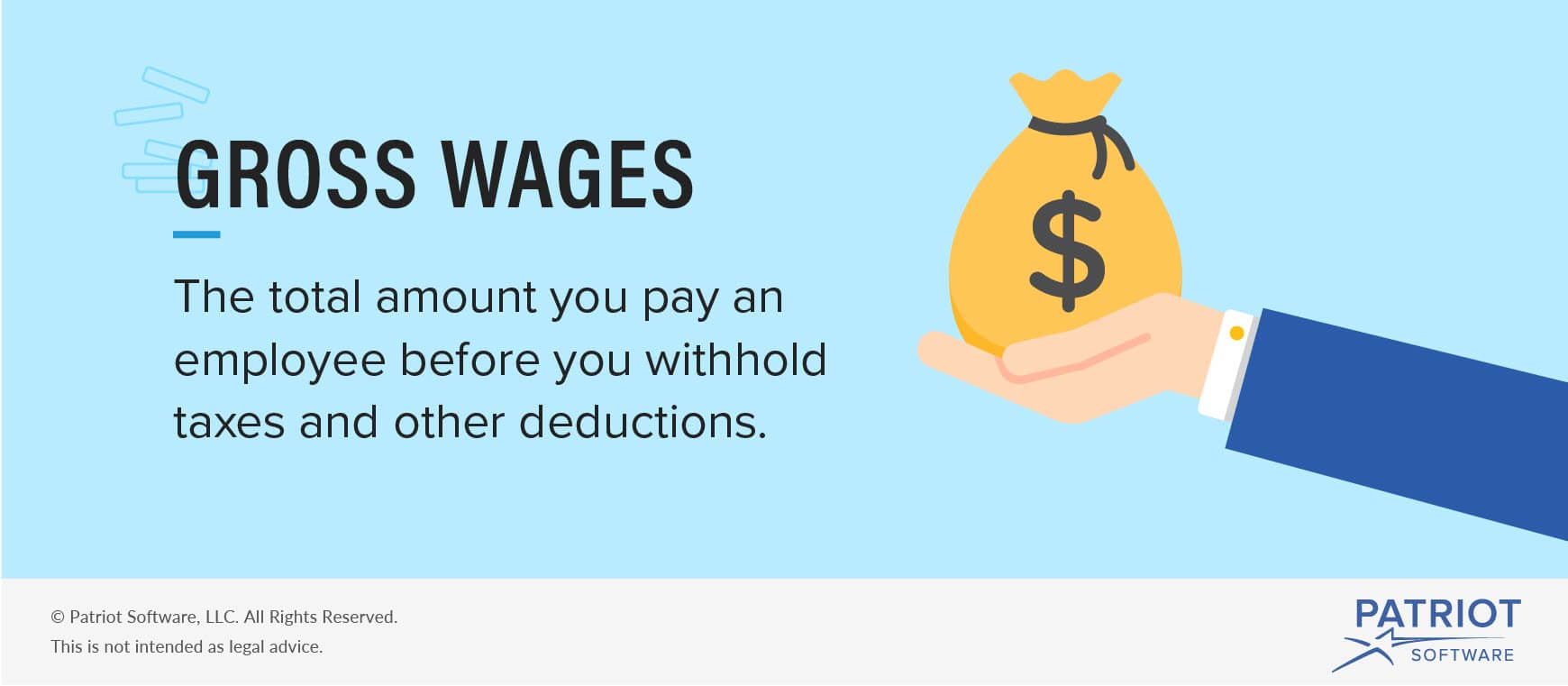

It is the gross monthly or annual sum earned by the employee. For instance if an employee is paid an. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted.

In terms of gross annual income women earned nearly 40 per cent less than men in 2010. The income may be from one source or multiple sources. Gross income is the total income of an individual before any deductions.

1 For companies gross income is interchangeable with gross margin or. In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. Gross Annual Income is The total amount of income earned expressed as an annual figure versus hourly or bi-weekly before taxes.

Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources. Gross family income or gross income means the combined annualized gross income of all persons residing or intending to reside in a dwelling unit from whatever source derived and before taxes or withholdings. Gross income includes any wages properties or services received before taxes and deductions.

Your gross income is the total amount of money you receive annually from your monthly gross pay. Revenue is the amount of income generated from the sale of a companys goods and. If you work fewer weeks you want to use that number instead.

Know How To Calculate Your Monthly Inflows Before Taxes Annualized Salary In the US there is no federal law that mandates pay frequency except one stating that employees must be. The total amount of a persons or organizations income in a one-year period before tax is paid on. Definition of Gross Income Annual income including overtime that is regular or guaranteed.

But will not include any deductions from section 80C to 80U. While the annual salary represents a floor for an employees wages gross pay can exceed that level. Salary is generally the principal source but other income may qualify if it is significant and stable.

UN-2 Gross annual income levels from 2001 to 2003 were reflective of employment levels. Gross annual income definition. Gross annual income is the amount earned by businesman in one financial year before income tax is to be calculated it includes income from all heads of incomelike house property 2busines income 3agriculture income 4 income from other sources like shares bank interest 5 income from professionbefore vl a deduction S 80cc and others.

It will also include profit or loss carried forward from past years and any income after clubbing provisions. This concept is normally used for individuals. An individual or companys income before taxes and deductionsFor individual income it is calculated as the individuals wages or salary investment and asset appreciation and the amount made from any other source of incomeIn a company it is calculated as revenues minus expensesAn individuals gross income is important to determining eligibility for certain social programs while a.

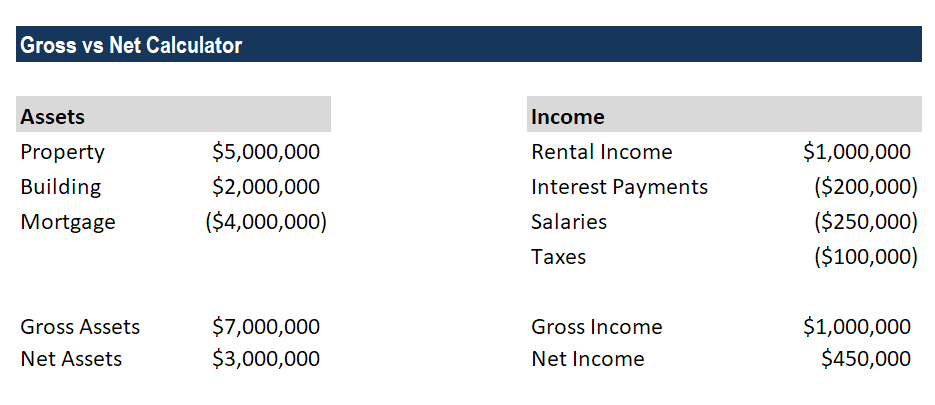

Gross annual income refers to all earnings before any deductions are made and net annual income refers to the amount that remains after all deductions are made. Estimated number of hours worked per week x hourly rate x 52 gross annual income. This income is also called as Gross pay and its the total amount an individual receives from his or her employer before any kind of deductions.

Gross income for individuals From a wage earners perspective gross income is money earned before things like taxes or other deductions are taken out. For the purpose of this definition annualized gross income means gross monthly income multiplied by 12. Gross income which is also known as gross pay before tax pay or pre-tax income is the income that an individual makes before taxes.

Your gross annual income and gross monthly income will always be larger than your net income. Content How Salary Works Annual Net Income How Much Money Will You Make Working A Minimum Wage Job. Gross profit represents the income or profit remaining after the production costs have been subtracted from revenue.

It is the gross monthly or annual sum earned by the employee.

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Operating Income Vs Gross Profit

Gross Annual Income Calculator

Gross Income Definition Formula Examples

Gross Profit Essentials You Need To Know About Gross Profit

What Are Gross Wages Definition And Overview

What Is Gross Income For A Business

The 1 10th Rule For Car Buying Everyone Must Follow

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Formula Step By Step Calculations

What Income Level Is Considered Rich Financial Samurai

Gross Vs Net Learn The Difference Between Gross Vs Net

What Income Level Is Considered Rich Financial Samurai

Gross Income Formula Step By Step Calculations

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

Gross Income Definition How To Calculate Examples

Post a Comment for "Gross Annual Income Me Meaning"